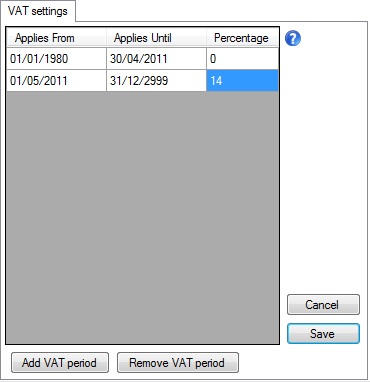

VAT settings

This tab enables you to configure VAT rates and the date periods to which they

apply.

The Applies From and Applies Until columns will

display a

DatePicker

if you click on one of the cells, allowing you to adjust the date.

The Percentage column displays the VAT rate applicable to the

period. Note that if you are not registered for VAT you should enter a

zero in this column.

The example displayed above shows a practice that was registered to start

charging VAT on 1 May 2011. It has been configured not to charge

VAT on transactions up to the end of April. Transactions from 1 May onwards

will have a VAT portion.

Note that VAT is calculated as a portion of the charge, i.e. it is NOT added on

top of the price you charge for each item. It is important, therefore, to

ensure that your Pricelists

are inclusive of VAT.

When filling out your VAT return you can use the

Transaction Analysis

to provide you with the required figures. It can be used for both the

invoice and cash basis of calculating VAT. Ask your accountant for more

details.

|